I sat at a large conference room table in the CPA firm where my long-time colleague and friend, Jeff, was the senior partner. We had worked on several transactions together over a ten-year period and helped several of his clients exit and sell their businesses. I had used his firm for quality of earnings reviews for numerous buy-side clients and for businesses we were selling.

At this meeting was David, Jeff’s longtime client. Jeff knew him and his company well, as his firm prepared its financial statements and tax returns. According to Jeff, David was concerned that since he was getting older, he wanted to discuss exit, succession, and transition options. David had brought to the meeting his two sons who worked in the business in minor roles. Also present were a minority partner who worked in the business with him, and Kevin a life-long friend and company CFO. Due to confidentiality, I am changing the names and business information.

Jeff had told me before the meeting that David was worried that neither of his sons had the capability to successfully take over the business, and he was uncertain as to the next steps to take. We had prepared a pitchbook that covered the various options for him to consider. These included the transition to his heirs, the sale to the minority partner, the sale to a strategic or financial buyer, and a business valuation estimate. As I reviewed the options, it was clear by the lack of substantive questions that David did not know which option he preferred, nor did his sons have a preference. The minority partner asked a few questions about his options. It was a rather short presentation and meeting.

After David and his team left, Jeff and I discussed what he would do next to follow up. Soon we were interrupted by Jeff’s receptionist who said David and Kevin were back and wanted to meet with us. Jeff opened the door and the men returned to their seats of a few minutes ago.

David told us that his boys and the minority owner had left in separate cars and that he wanted to talk to us confidentially. He then began to share his concerns in detail that he did not feel either of his sons were ready or capable of running the firm. One son was more interested in racing cars and traveling to NASCAR events nationwide, and the other was a computer geek who did not relate or work well with David or the other employees. He further explained that he would soon turn 65 and was concerned about his slowly declining health. He said the nature of the business demanded that he travel a great deal and work 12-14-hour days, including weekends. He was tired of the daily grind, the constant pressure on cash flow, and was not sure he wanted to continue to devote all the necessary hours it took to keep the business successful. In addition, he was also worried about two competitors who had been taking business from him over the past two years.

Kevin then spoke up and shared with us that he too did not believe David’s two sons could take over the business and be successful, given their lack of motivation and self-initiative. He stated that he did not see them having the same drive for success that David did. He went on to share that the minority partner was not well-liked within the organization and if he bought the company from David, most of the best employees would leave. He said if he had to choose between the two sons or the minority partner, he thought that David’s children would be preferable.

David then shared that he felt he had been too easy on them when they were growing up and attending college. “I think they were simply coasting and waiting to come into the business. The problem is that they are not prepared to take it over and I don’t know if they ever will be. I don’t want them to ruin the business and put all our great employees out of work,” David said. Also, David shared that he wanted his youngest daughter who was married and living in California to get an equal share of the value of the business.

Jeff asked a few questions about David’s health, estate planning, and when he would like to be in a position to exit or transition out of the company. David said he hoped to retire to part-time in about a year to eighteen months at the latest.

The conversation then gravitated to me. I shared with them that this was not an untypical situation. We have worked with many family business owners and we are always learning, reading, and thinking about what the best way is to handle a family business transition and not destroy the family. I stressed that every family situation is unique and each one must find its own solutions to their particular succession and transition issues. I explained that a key to success is that whatever course of action David took should take into consideration the unique quirks and personalities of his family.

David then shared that as long as he could remember, the business had been an integral part of his life. “If you asked me who I am apart from the business, I would say I don’t know. I’m trying to come to grips with not having the business anymore. Unfortunately, I don’t see my two boys having the same focus or desire, as Kevin has said. It will be hard for me to sell it – it would be far easier for me to just give it to my boys to run. Then I could dabble when I wanted to.”

Kevin spoke up and said that he did not think the boys would keep it going successfully without David’s help, and that he would soon be dragged back in full time to save it.

At that point I asked David to articulate his ideal succession and transition plan. He said that he wanted to turn it over to someone who would be a good owner for his customers and employees and preserve the legacy of the business.

I told David and Kevin that, when possible, we recommend developing a business succession and transition plan over several years. However, it could be accomplished more quickly if necessary.

We have found that we can increase the success of a business transition, including achieving the transfer of wealth, if we execute all the major steps in the process correctly and efficiently.

The earlier we can start the transition, the better chance for success. Ideally, we suggest a two-year time period, but it can be shorter if required. When the exit, succession, and transition process is rushed through and not thoughtfully planned and executed, the outcome can be a disaster.

The first step in the process must be for the business owner to make a firm decision to commit to moving forward with the exit, succession, and transition of the business to a new owner. Hesitating or starting and stopping the process will result in a variety of terrible outcomes.

Next, it is crucial to understand that while the process can often be acrimonious, successful transition is the true objective. Over the thirty years in which I have worked in mergers and acquisitions for buyers and sellers, I know how hard it can be for a business to be successfully transitioned to the next generation. Seventy percent of family businesses fail during their second generation. But it’s important to remember that family businesses offer an opportunity for great success, and family relationships give firms comparative advantages over their rivals. Working though the succession and transition may be difficult and even painful at times, but it can have a positive outcome in the end.

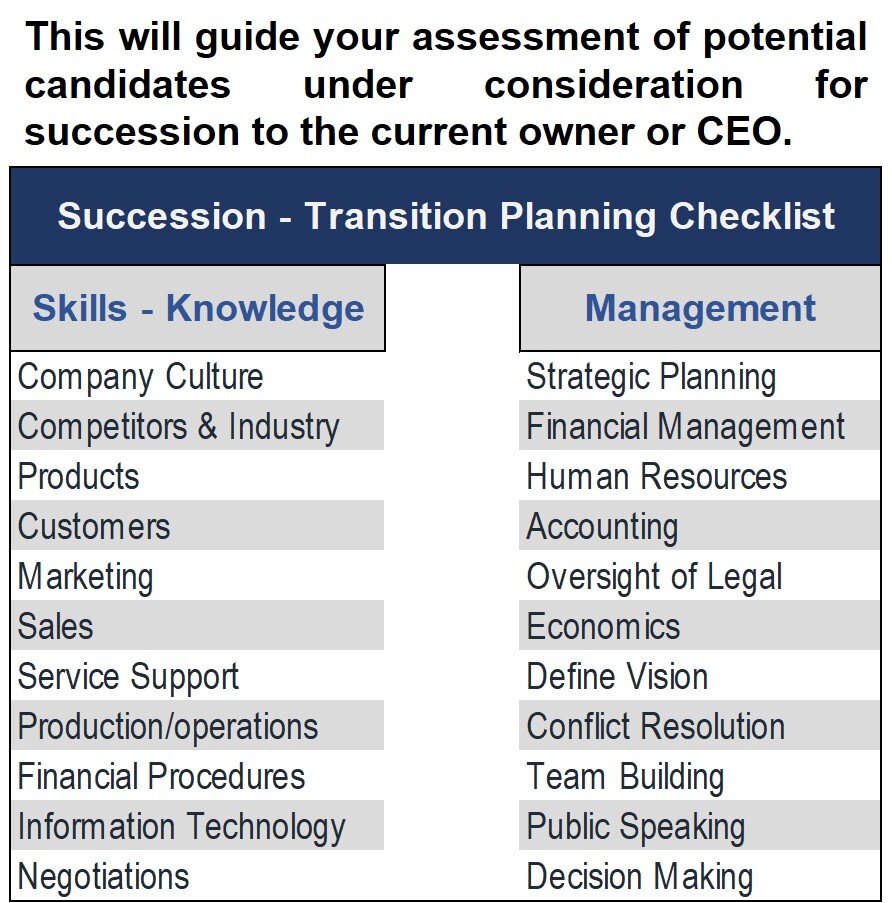

The next key action is to prepare the next generation for the transition. This may be one of the hardest issues to confront. For David, he was not convinced that neither of his two sons had the leadership or management ability required to be the president or CEO of his business. Clearly, David needed to consider other transition alternatives. We have found that thoroughly critiquing the next generation in terms of leadership and skill set is crucial to determine their chances of success. The chart to the left lists many of the key skills and capabilities we use to help the owner of a business work through the succession and transition challenges.

Next, anticipate and address potential conflicts that might arise while executing the plan. This will require an honest assessment of how the key members of the family will react to the succession and transition plan. One way to look at this is to envision a post-transition family dinner after all is completed and imagining the future relationships between David and his heirs, sibling rivalries, and how pleased everyone is that the family no longer owns the business.

Once the business owner makes the decision to move forward, a detailed exit, succession, and transition plan must be created. This plan should clearly state the goals and objectives for the business owner’s exit, succession, and transition and how they will be achieved. An implementation timetable should also be developed that forecasts when all the steps in the process will be completed. Once this is finalized, everyone must adhere to the timetable in the plan.

It is imperative that the plan be kept very confidential. If the owner’s intentions of exiting the business become known, it could hurt the business and the owner’s goals and objectives. When word gets out that there are changes coming in ownership, we have seen employees leave and customers take their business elsewhere. Confidentiality is a key to success.

We also encourage making the succession and transition plan a part of the current overall business plan and objectives. This ensures that the succession and transition plan elements will be embedded within the entire organization and the timetable is adhered to.

Next, once the succession and transition plan is finalized, clearly articulate it in appropriate detail to the immediate family members, any top-level employees who will need to be a part of the transition process, and any vital stakeholders. We define vital stakeholders as the following: major customers, crucial vendors, shareholders - owners, major supply chain partners, and others who are impacted by the business. If any of them will play a role in the implementation of the plan, they should be confidentially brought into the process – for example, the CPA firm, bankers, lawyers, and key customers (if the buyer wants to talk with customers). Later in the process, Human Resources, and others will need to be confidentially made aware of the transition.

One of the crucial elements to the success of any exit, succession, and transition is to ensure that a strong management team is in place to support the next owners. The more experienced this management team is, the greater chance of early success.

As I reviewed these crucial actions that I felt were appropriate for David and his business, I could tell that the primary area where he was struggling was with the capabilities of his children.

At that point, I asked Kevin that even though he was adamant David’s sons should not be running the business, if he felt that they could add value in continuity or transition to a new ownership team. Kevin brightened up considerably and stated that he believed they could be somewhat valuable to the new owners because they knew the business, customers, vendors, and grew up in the business.

At that point, it was clear to me there was one optimal path to take. I suggested to David and Kevin that a good solution was to find a suitable strategic buyer for the company who would be a good owner for his customers and employees, and allow both sons, if they are willing, to remain on following the sale as equity shareholders in the business. I shared with them that often buyers like to have owners remain active in the business for several years to ensure that the transition to the new ownership team is a success.

I suggested that we could most likely sell 80% of the shares of the business to a new owner with David’s sons each owning 10%. We also would ask them to agree to three-to-five-year employment agreements and a buy-sell agreement. If his sons did not want to stay on working for the new owners, we would sell 100% of his shares to the new owner. Either way, this would allow David the opportunity to have an immediate liquidity event that would provide him the cash to set aside for his daughter in California.

Jeff then took the lead on the nuances of tax implications and how we could structure the transaction agreement from a tax and estate perspective. He was very enthusiastic about the sale opportunity and encouraged David to strongly consider that option rather than the transition to his sons. Kevin was also in agreement.

We continued to talk about the next steps. I told David and Kevin that I would send them an engagement agreement and a request of information on the business that we would need in order to prepare the Confidential Information Memorandum we would confidentially send to potential buyers.

Six months later, we sat in Jeff’s conference room again and signed the purchase agreement we had negotiated with a strategic buyer who was paying a premium price for the business. David, Kevin, David’s sons, and even the minority owner were incredibly pleased with the sale and its proceeds.

As you can see, there are a myriad of issues that impact the transition of business ownership from one family generation to the next. A successful exit, succession, and transition must be carefully and thoughtfully planned and executed.

If you or a business owner you know are contemplating the future transition of your business, I am available for a confidential discussion.